FAMILY TREE CHANGING WORKSHOP

The Real Estate Conference That Makes You Money

In just 3 days… We will teach you all the tax, legal, financial planning, and real estate investing strategies that your CPA, attorney, financial advisor or real estate guru won’t. So that you can build generational wealth and change your family tree.

Live in Chicago, IL April 27th-29th

Ryan Bakke, CPA & friends will break down the strategies that you need to know for 2025.

Join Us for a 3-day event to learn everything you need to know about tax, legal and financial secrets.

This isn’t your typical boring tax talk—we promise real insights, actionable strategies, and zero fluff!

In order to change your family tree you must...

Know all the tax strategies available to you.

Know how to grow your wealth using financial plans.

Protect the wealth through proper legal structure

Have the right coaches and mentors that other people won't tell you.

Words like exhausted, overworked, and undervalued have become all too common in the business industry.

General Admission Ticket

Tax Strategy, Financial Planning and Legal for Business Owners and Entrepreneurs.

Family Tree Changing Workshop

Transform your financial future and reshape your family tree with strategies that empower you to build and protect generational wealth.

WHAT YOU’LL LEARN:

Tax Strategy Mastery: Optimize your tax approach to save more and reinvest in your future.

Financial Planning Essentials: Create a personalized roadmap for long-term financial security and growth.

Legal Foundations for Wealth Protection: Establish structures that safeguard your assets and ensure a lasting legacy.

Bonus: Real Estate Coaching and Mentoring: Unlock the secrets to successful real estate investing with hands-on guidance.

Guest Speakers

Brenna Carles

CEO and Founder of the Mortgage Shop

Tyler Murphy

Founder at Strongside Asset Management LLC

Jeff Hampton

Owner and Managing Partner of STR Law Guys

Bill Faeth

Founder of Build Short Term Rental Wealth

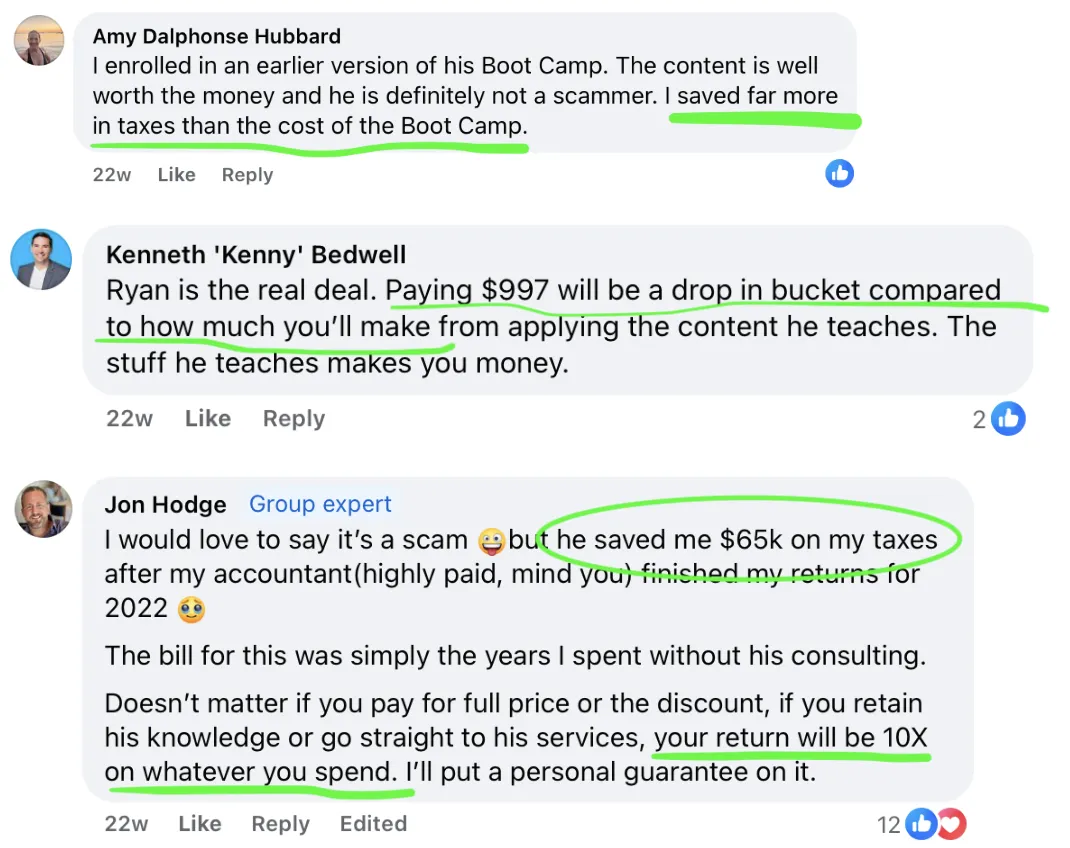

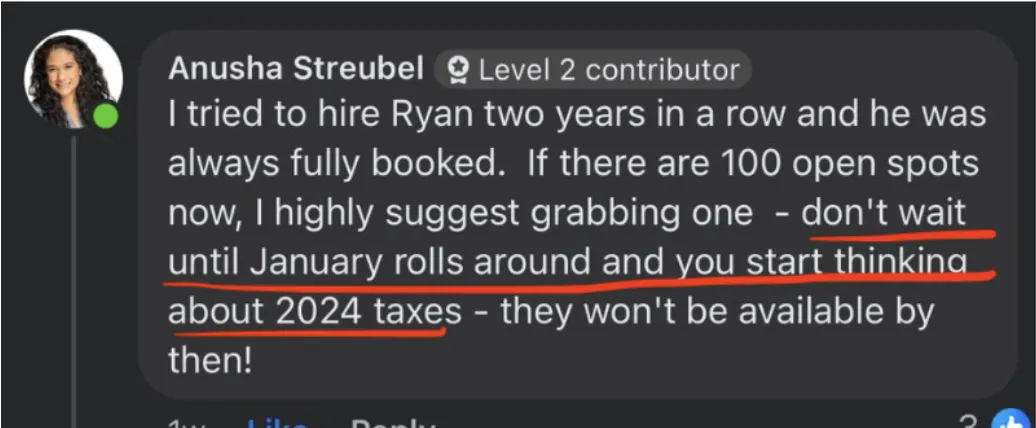

Learn What Others Have to Say

Choose Your Journey to Tax Excellence

Journey 1

Building a Tax Advisory & Consulting Practice

Scale, streamline, and systemize your advisory business.

Turn compliance clients into year-round advisory opportunities while mastering operational efficiencies for sustainable growth. This track covers pricing, hiring, marketing, and client engagement essentials to help you build a practice you love.

WHAT YOU’LL LEARN:

Crafting solid engagement letters and pricing models.

Transforming compliance clients into year-round

partners.

Marketing

strategies that drive consistent growth.

Recruiting and training the right team to scale your business.

Bonus:A Power Checklist for the ultimate year-end tax planning session.

Journey 2

Tax and Legal Foundations: Core Strategies for All Levels

Master the fundamentals that drive financial success.

Perfect for business owners and advisors, this track delivers essential insights on asset protection, tax planning, estate strategies, and IRS compliance.

WHAT YOU’LL LEARN:

Unlock estate planning with Revocable Living Trusts.

Maximize retirement savings through Solo 401(k) plans.

Real estate strategies: Short-term, long-term, and self-rentals.

Learn asset protection that actually works.

Navigate IRS resolution with confidence and ease.

Journey 3

Advanced Insights: Unlock Complex Tax Strategies

Top-tier strategies for high-value clients.

Designed for experienced professionals, this track offers in-depth guidance on prime tax strategies, entity structuring, and payroll solutions. Gain the insights needed to handle complex business scenarios with confidence.

WHAT YOU’LL LEARN:

Report multi-entity structures with Forms 1065 & 1120S.

Maximize tax savings using Bonus Depreciation & Section 179.

Seamlessly relocate clients to tax-free states.

Navigate business sales and acquisitions smoothly.

Use 105 Plans to save clients on healthcare costs.

Previous Talks

CHICAGO, ILLINOIS

April 27th-29th

Everything begins on April 27th with a Welcome Reception, followed by three exciting days filled with engaging sessions, great food, and plenty of fun. Grab your seat and connect with your tribe!

3200 Squibb Ave Rolling Meadows IL 60008

Hyatt Regency 1800 East Golf Road Schaumburg

WE WANT TO MAKE THIS SESSION AN AWESOME EXPERIENCE FOR YOU!

Get ready for an engaging workshop designed to transform your approach to tax strategies and financial planning. This isn’t just another session—it’s your chance to shine during our

Live Q&A Hot Seat, where you can share your unique challenges and receive expert, real-time guidance tailored to your needs.

But that’s not all! Attendees will also enjoy exclusive perks, including:

Personalized Tax Strategy Toolkit: Simplify your planning with a customized set of tools designed to fit your goals.

Exclusive Access to a Private Community: Stay connected, gain support, and network with like-minded professionals.

Practical Bonus Resources: Streamline your workflow with templates, checklists, and actionable guides.

One-on-One Follow-Up Consultation Voucher: Receive tailored advice to address your specific needs and challenges.

Tax talks don’t have to be boring…

they can be fun too!

2024 Tax Strategy 365. All rights reserved.