WAIT! Your order is not finished yet!

Want to work 1-1 with a proactive real estate CPA to strategically save $10k+ on your 2024 tax bill?

How would you like to work 1-1 with a talented real estate CPA & tax strategist to reduce your 2024 tax bill?

You've already made a smart move by purchasing your Tax Strategy Bootcamp ticket. But we're about to sweeten the deal with the opportunity to work with one of our real estate tax strategists 1-1, building you a tax strategy to save in both 2024 AND 2025!

This is Tax Strategy 365 — we don't just wait till April to think about taxes, we play the tax game 365 days a year, building wealth tax-free through real estate.

When you join Tax Strategy 365, you'll get:

1-1 meetings with your real estate CPA: Understanding your goals in real estate, building your custom tax plan, and guiding you every step along the way

Prior year tax return review: Finding any and all missed deductions from past CPAs/tax preparers

Weekly LIVE "Office Hours" with Ryan: 60-90 mins of weekly Q&A time on any real estate or investing topic

Priority access to our tax preparation team: Get your returns filed by our team of real estate tax prep specialists

24/7 email access to your real estate CPA: to answer your questions and guide you in the moment, on demand (48hr response time Mon-Fri guaranteed)

200+ hours of exclusive real estate content: covering tax strategy, investing strategies, seller financing, and more

Meet Your Real Estate Tax Strategy Advisors:

Ryan Bakke, CPA

Founder, Tax Strategy 365

Austin Prevost, CPA

Director of Tax Strategy, Tax Strategy 365

We've saved our clients $10M since 2021

Here are their stories:

Audrey // Travel Nurse

Income: $180k

Tax Savings: $33,120

Brian // Mortgage Loan Officer

Income: $869k

Tax Savings: $102,860

Amy // Teacher + Short-Term Rental Investor

Amy had her returns filed by her local CPA, but they didn't understand real estate and repeatedly made mistakes.

She brought her returns to us and we found $24,000 of tax savings her past CPA didn't catch.

Ross & Jen // Short and Long-Term Rental Investors

Started working with us in 2021, owned 1x LTR and 1x STR.

Today, they own 5x properties, and pay less in taxes than when they had 2

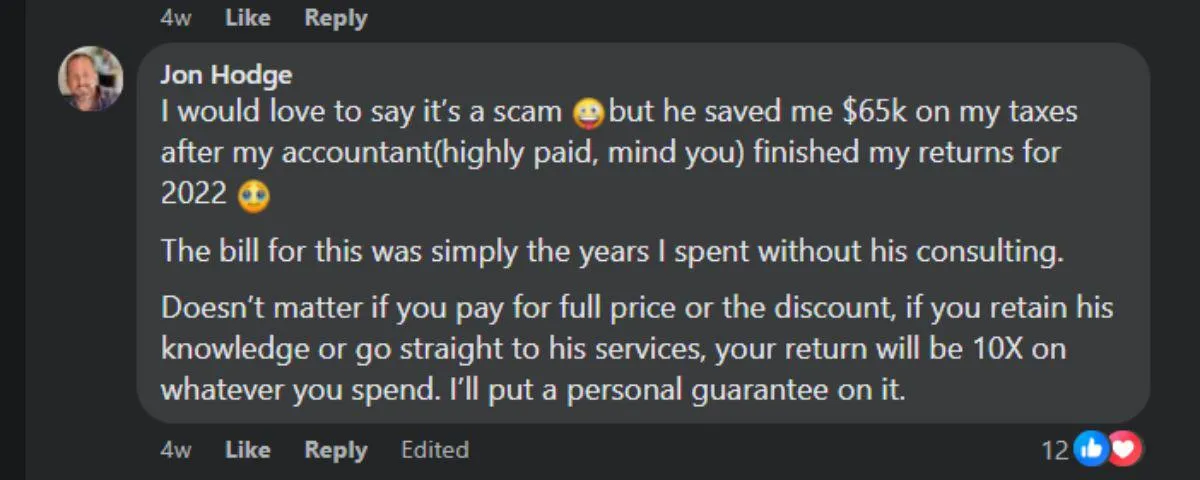

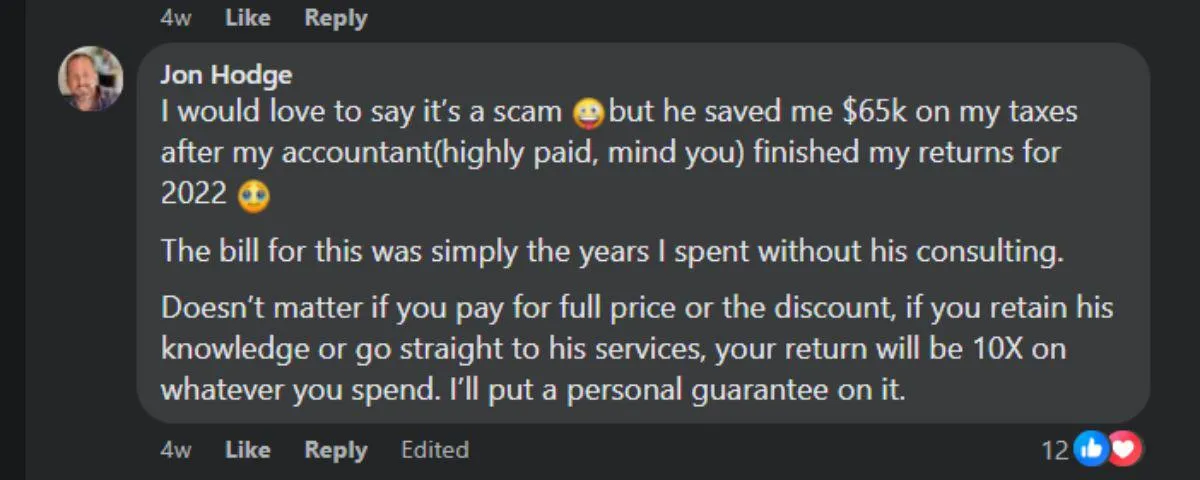

Jon // Business Owner + Real Estate Investor

Jon had his past accountant prepare his return for 2022, but the tax bill seemed higher than it should be...

He brought it to us for a review and we found $65,000 in missed savings!

Jenny // Short-Term Rental Investor

Was told by her past CPA that her STRs didn't qualify for tax benefits.

She came to us, and we found $90,000 of tax savings from prior years!

Trevor // Realtor + Real Estate Investor

Trevor was set to owe $60,000 in taxes when he came to work with us.

We helped him buy a short-term rental for $60,000 down, taking his tax bill down to $21,000. The US government essentially paid 2/3 of his down payment!

We've saved our clients $10M since 2021

Here are their stories:

Audrey // Travel Nurse + Short-Term Rental Investor

Income: $180k

Tax Savings: $33,120

Brian // Mortgage Loan Officer + Real Estate Investor

Income: $869k

Tax Savings: $102,860

Amy // Teacher + Short-Term Rental Investor

Amy had her returns filed by her local CPA, but they didn't understand real estate and repeatedly made mistakes.

She brought her returns to us and we found $24,000 of tax savings her past CPA didn't catch.

Ross & Jen // Short and Long-Term Rental Investors

Started working with us in 2021, owned 1x LTR and 1x STR.

Today, they own 5x properties, and pay less in taxes than when they had 2

Jon // Business Owner + Real Estate Investor

Jon had his past accountant prepare his return for 2022, but the tax bill seemed higher than it should be...

He brought it to us for a review and we found $65,000 in missed savings!

Jenny // Short-Term Rental Investor

Was told by her past CPA that her STRs didn't qualify for tax benefits.

She came to us, and we found $90,000 of tax savings from prior years!

Trevor // Realtor + Real Estate Investor

Trevor was set to owe $60,000 in taxes when he came to work with us.

We helped him buy a short-term rental for $60,000 down, taking his tax bill down to $21,000. The US government essentially paid 2/3 of his down payment!