REAL ESTATE INVESTORS!

THE IRS HAS HAD YOU FOR TOO LONG!

Learn How to Save $10,000s in taxes without lifting a finger.

Build Tax-Free

Wealth in 3 Easy Steps

Apply to work with us to build wealth instead of the IRS' bank accounts...

STEP # 1

Discovery

We uncover missed opportunities to save on taxes in your current portfolio.

STEP # 2

Planning

We help you create a customized tax game plan tailored to your financial goals.

STEP # 3

Implementation

Hands-on execution with ongoing support and weekly office hours!

Investing Made Simple

I've made it my mission to help real estate investors (just like you and me) create generational wealth and build a better life. Every family has that one person who's going to change their family tree forever, and I'm doing everything I can to guide you along that path.

Tax Strategy Blueprint

Strategy to implementation, we can walk you through it all.

Service # 1

Tax Strategy

Create a tax plan for your upcoming year situation!

Service # 2

Tax Filing

We offer personalized tax preparation services, maximizing deductions while ensuring compliance with tax laws.

Service #3

Cost-Segregation Studies

We specialize in cost segregation studies, identifying and maximizing depreciation deductions to optimize tax savings for property owners.

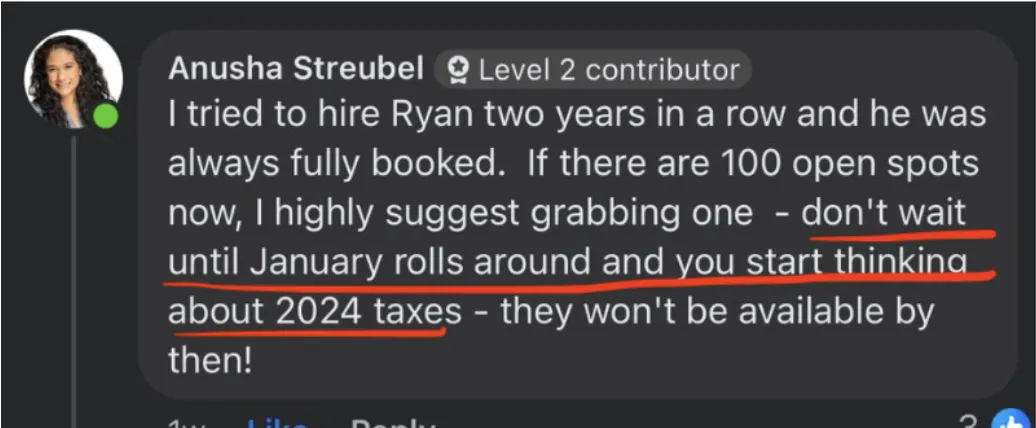

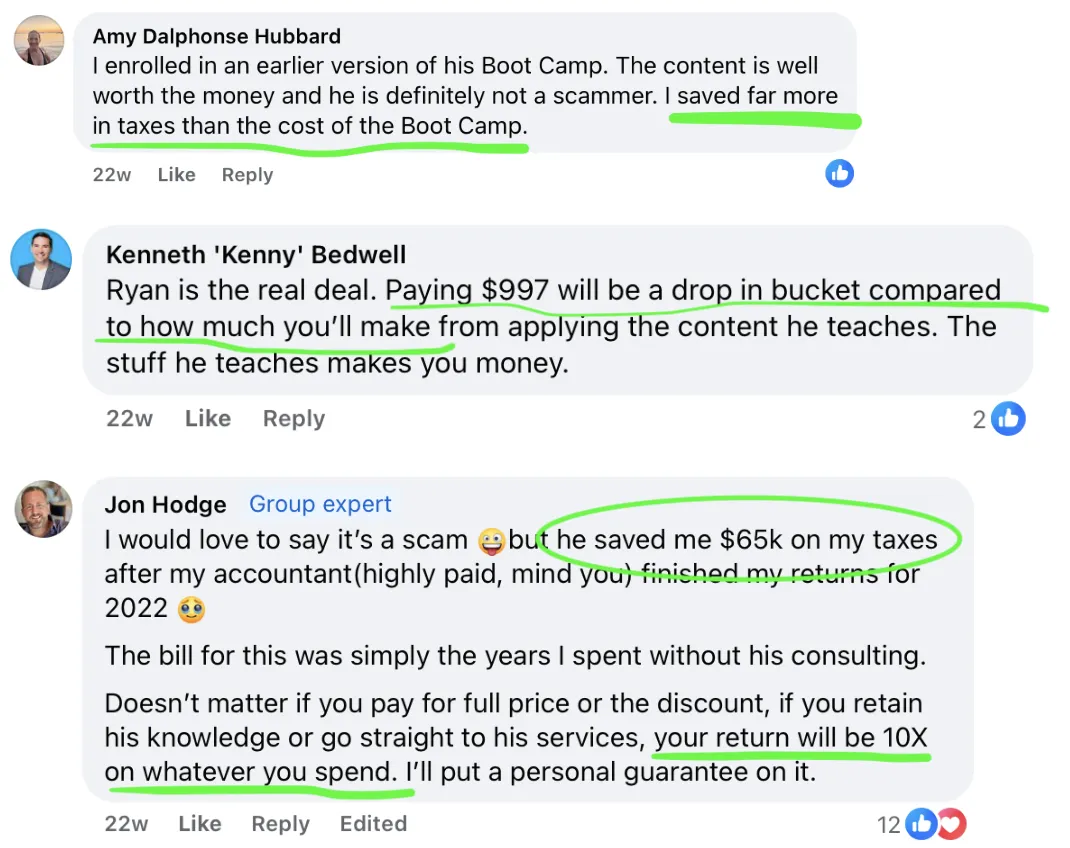

Hear Our Client Success Stories

Ryan Bakke, CPA

Taxes will be the largest expense of your life.

The second biggest expense is the cost of not knowing how to save $10,000s+ a year in taxes.

I pride myself in knowing that I help 400+ Real Estate Investors per year save money on their largest lifetime expense!

If you are the person in your family that is going to change your family tree - I want to work with YOU!

Meet the Experts

Austin Prevost, CPA

Director of Tax Strategy 365

Austin grew up in Nashville and comes from a large family of real estate investors. He has over 5 years of experience as a CPA and started out his career in Big 4 at Deloitte.

Austin prides himself in adding value to our clients by identifying their needs. He has extensive experience working one on one with real estate investors to develop and implement a tax strategy plan that optimizes tax savings.

Laura Bucko

COO of Tax Strategy 365

Overseeing daily operations, and the new client consultation. She is also a real estate investor and developer specializing in short-term rentals and single-family home developments.

Elizabeth Hernandez, CPA

Tax Manager

Elizabeth will be overseeing your tax return preparation. She will be the point of contact to help get you the most money back on your tax return!

Elizabeth is a Real Estate CPA and Investor herself!

Mason Kimball, CPA

Tax Advisor

Mason, a New Jersey native now based in Philadelphia, has been a CPA since 2019 and honed his tax expertise at EY. He specializes in real estate investment tax strategies and is an active real estate investor himself.

Passionate about teaching, Mason helps clients build wealth through smart real estate investments while minimizing their taxes.

Kevin A. Medina, CPA, MBA

Tax Advisor

Kevin is a committed and ambitious tax CPA & financial services professional. He earned his bachelor's degree in Accounting and then an MBA with a concentration on entrepreneurship from his hometown, Florida Atlantic University (FAU).

Kevin is a licensed CPA, Financial Professional, and Florida Realtor, dedicating himself to helping clients with everything related to money including taxes, personal finance, retirement planning, real estate, and estate planning. His goal is to teach families what should have been taught in school in order to help prepare them for a better financial future!

Resources

Access our array of free resources designed to empower you on your journey to financial prosperity.

2024 Tax Strategy 365. All rights reserved.