Latest blogs and articles

Leading you to a better financial future.

Unlocking Tax Savings: Short-Term Rental Strategies for Investors

Unlocking Tax Savings: Short-Term Rental Strategies for Investors

Investing in real estate is one of the most powerful ways to reduce your tax burden, especially for individuals with high W-2 or business income. The government incentivizes real estate investment, and as you transition from traditional income streams to real estate, your overall tax rate will decrease. For those diving into short-term rentals, the tax benefits can be even more substantial, thanks to what’s commonly referred to as the “short-term rental loophole.”

What is the Short-Term Rental Loophole?

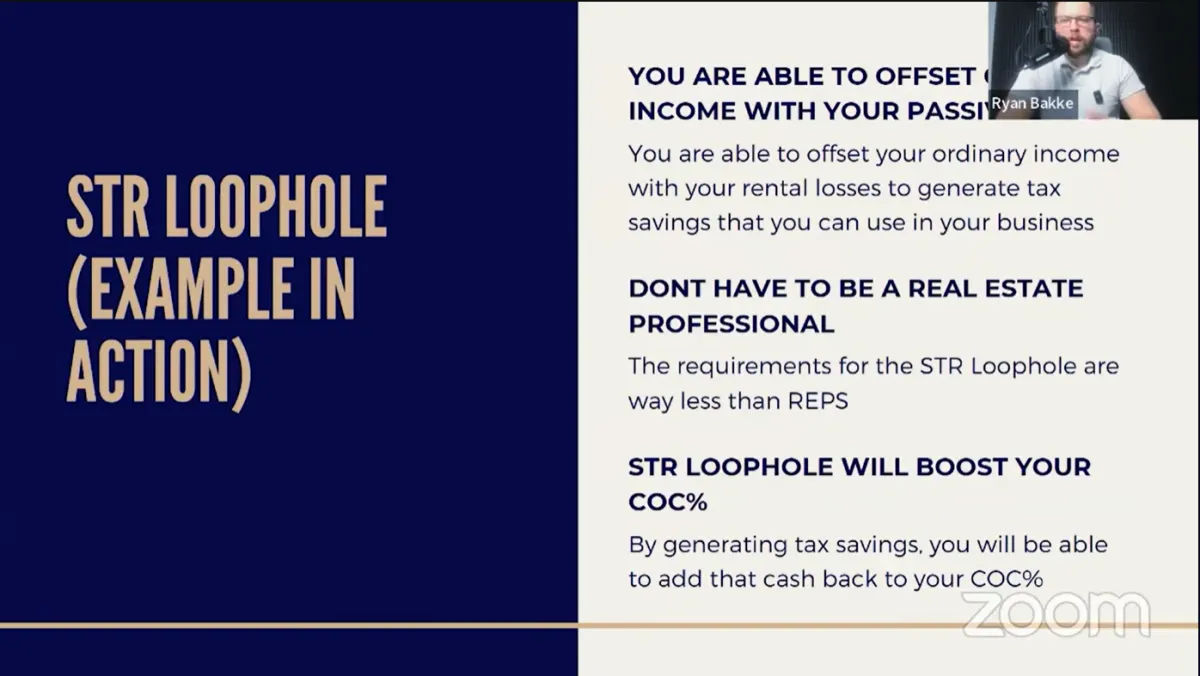

Typically, to take advantage of rental losses—like depreciation—against your active income (W-2, business, or retirement income), you need to qualify as a real estate professional. However, the short-term rental loophole changes the game. You can use rental losses from short-term rentals to offset your W-2 and other active income without qualifying as a real estate professional. This is a major advantage for high-income earners looking to reduce their tax bill.

To qualify, the average stay for your rentals must be seven days or less. It’s important to calculate the average stay by dividing the total days your property was rented by the number of unique guests. For example, if you rent your property for 150 days with 50 different guests, your average stay is 3.0 days.

Qualifying for the Loophole: Material Participation

Beyond ensuring the average stay is seven days or less, you’ll need to meet one of the seven material participation tests. This essentially means that you must self-manage your property. The two most common tests that investors meet are:

1. The 500-Hour Rule: You must spend a total of 500 hours across all your short-term rentals. For example, if you have three properties, you can combine the hours to meet this threshold.

2. The 100-Hour Rule: If 500 hours seems out of reach, you can qualify by working at least 100 hours and more than anyone else involved in managing the property, including cleaners and maintenance staff.

Tracking your time is crucial to meet these standards, and hours can include activities like property inspections, tenant communications, making offers, and managing repairs.

Why This Matters for High-Income Earners

The real benefit of the short-term rental loophole lies in its ability to help high-income earners reduce their tax liability by five or six figures. By taking losses from your short-term rental investments, you can significantly decrease the amount of your income subject to taxes—without the strict requirements that apply to long-term rental properties.

Remember, the goal is to take accelerated deductions while you’re still in a higher tax bracket. This will maximize the impact of the deductions and reduce your overall tax burden.

Additional Considerations

While using the short-term rental strategy, ensure you're holding your property in an advantageous structure. For most investors, owning property in their personal name with good insurance or through a single-member LLC offers the best tax treatment. Avoid corporations or S corporations, as they generally offer less favorable tax benefits for rental income.

In summary, by leveraging the short-term rental loophole, high-income earners can significantly reduce their tax liabilities while maintaining flexibility in managing their properties. It’s a smart strategy for those looking to transition from active income to passive income streams while taking full advantage of government incentives.

Choose Your Journey to Tax Excellence

Journey 1

Building a Tax Advisory & Consulting Practice

Scale, streamline, and systemize your advisory business.

Turn compliance clients into year-round advisory opportunities while mastering operational efficiencies for sustainable growth. This track covers pricing, hiring, marketing, and client engagement essentials to help you build a practice you love.

WHAT YOU’LL LEARN:

Crafting solid engagement letters and pricing models.

Transforming compliance clients into year-round

partners.

Marketing

strategies that drive consistent growth.

Recruiting and training the right team to scale your business.

Bonus:A Power Checklist for the ultimate year-end tax planning session.

Journey 2

Tax and Legal Foundations: Core Strategies for All Levels

Master the fundamentals that drive financial success.

Perfect for business owners and advisors, this track delivers essential insights on asset protection, tax planning, estate strategies, and IRS compliance.

WHAT YOU’LL LEARN:

Unlock estate planning with Revocable Living Trusts.

Maximize retirement savings through Solo 401(k) plans.

Real estate strategies: Short-term, long-term, and self-rentals.

Learn asset protection that actually works.

Navigate IRS resolution with confidence and ease.

Journey 3

Advanced Insights: Unlock Complex Tax Strategies

Top-tier strategies for high-value clients.

Designed for experienced professionals, this track offers in-depth guidance on prime tax strategies, entity structuring, and payroll solutions. Gain the insights needed to handle complex business scenarios with confidence.

WHAT YOU’LL LEARN:

Report multi-entity structures with Forms 1065 & 1120S.

Maximize tax savings using Bonus Depreciation & Section 179.

Seamlessly relocate clients to tax-free states.

Navigate business sales and acquisitions smoothly.

Use 105 Plans to save clients on healthcare costs.

2024 Learn Like A CPA. All rights reserved.