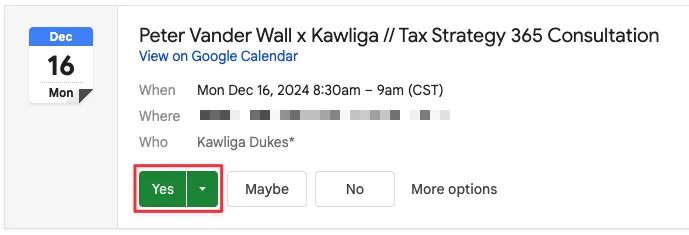

Step 1: Confirm your call

Respond "YES" to the text message we just sent you!

Confirm our call so it shows up on your calendar.

Step 2: Some additional information to prepare you for our call

What is included in the Tax Strategy 365 Service?

Review of prior year returns

Review of current legal structure

3- 1 hour Tax Planning call w/a member of our team

Weekly Office Hours/Ask me anything w/Ryan

Access to modules/templates that aren't available anywhere else

Unlimited Email Support

Full transparency and guidance on your tax plan/situation for the year

Does tax strategy include tax preparation?

Tax strategy and tax preparation are separate services with separate pricing.

That being said, if you're a tax strategy client, you'll get access to special pricing on your tax return preparation.

How much does tax preparation cost?

For tax strategy clients, tax preparation starts at $2,200.

Without an active tax strategy package, tax preparation starts at $3,000.

I've never paid this much before. Why should I now?

We understand we may not be the lowest priced option around.

However, unlike most CPAs who simply prepare and file tax returns and never give any advice on how to improve your tax situation, we will be providing you with advice on how you can best take advantage of the tax code to minimize your tax bills and have the peace of mind that you’re not missing out on major tax-saving opportunities.

Additionally, most CPAs are generalists and aren’t even aware of all the opportunities, and in some cases, we’ve found they may actually be costing you money - making them not so cheap after all!

Where are you located?

We are a 100% virtual organization with members across the United States.

Do you provide audit support?

We do provide audit support for an additional hourly fee.

Step 3: Learn about our tax strategy methods

Watch/listen to The Ryan Bakke Show on all platforms

Year-End Tax Planning For Real Estate Investors

I Defended An AirBnB Host From An IRS Audit... Here's What Happened

"These Retirement Companies Are In Cahoots With The IRS!" (Roth Conversion Planning)

Step 4: Hear from our successful tax strategy clients

We've saved our clients $14M since 2021

Audrey // Travel Nurse + Short-Term Rental Investor

Income: $180k

Tax Savings: $33,120

Brian // Mortgage Loan Officer + Real Estate Investor

Income: $869k

Tax Savings: $102,860

Amy // Teacher + Short-Term Rental Investor

Amy had her returns filed by her local CPA, but they didn't understand real estate and repeatedly made mistakes.

She brought her returns to us and we found $24,000 of tax savings her past CPA didn't catch.

Ross & Jen // Short and Long-Term Rental Investors

Started working with us in 2021, owned 1x LTR and 1x STR.

Today, they own 5x properties, and pay less in taxes than when they had 2

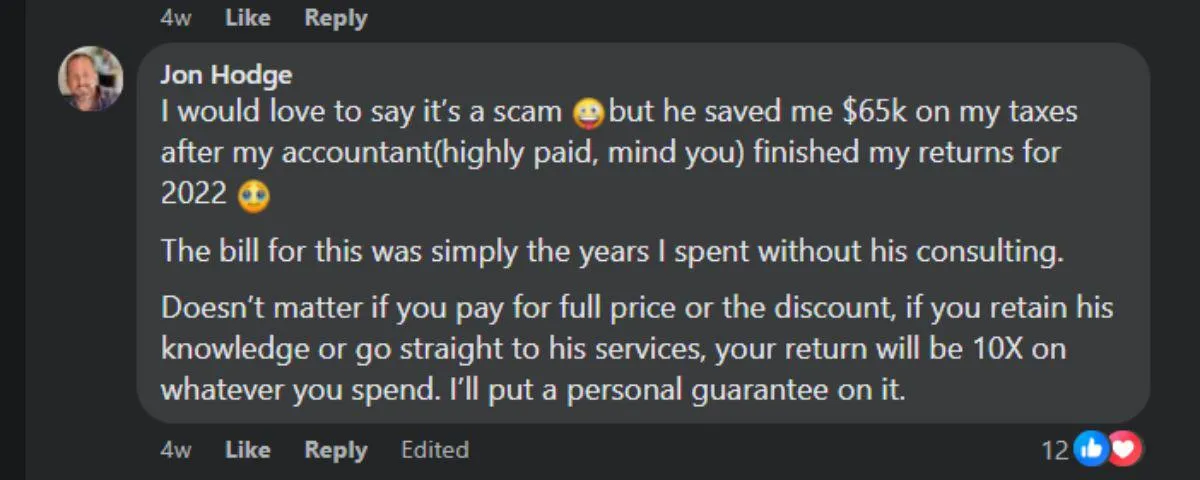

Jon // Business Owner + Real Estate Investor

Jon had his past accountant prepare his return for 2022, but the tax bill seemed higher than it should be...

He brought it to us for a review and we found $65,000 in missed savings!

Jenny // Short-Term Rental Investor

Was told by her past CPA that her STRs didn't qualify for tax benefits.

She came to us, and we found $90,000 of tax savings from prior years!

Trevor // Realtor + Real Estate Investor

Trevor was set to owe $60,000 in taxes when he came to work with us.

We helped him buy a short-term rental for $60,000 down, taking his tax bill down to $21,000. The US government essentially paid 2/3 of his down payment!

Step 4: Hear from our successful tax strategy clients

We've saved our clients $14M since 2021

Audrey // Travel Nurse

Income: $180k

Tax Savings: $33,120

Brian // Mortgage Loan Officer

Income: $869k

Tax Savings: $102,860

Amy // Teacher + Short-Term Rental Investor

Amy had her returns filed by her local CPA, but they didn't understand real estate and repeatedly made mistakes.

She brought her returns to us and we found $24,000 of tax savings her past CPA didn't catch.

Ross & Jen // Short and Long-Term Rental Investors

Started working with us in 2021, owned 1x LTR and 1x STR.

Today, they own 5x properties, and pay less in taxes than when they had 2

Jon // Business Owner + Real Estate Investor

Jon had his past accountant prepare his return for 2022, but the tax bill seemed higher than it should be...

He brought it to us for a review and we found $65,000 in missed savings!

Jenny // Short-Term Rental Investor

Was told by her past CPA that her STRs didn't qualify for tax benefits.

She came to us, and we found $90,000 of tax savings from prior years!

Trevor // Realtor + Real Estate Investor

Trevor was set to owe $60,000 in taxes when he came to work with us.

We helped him buy a short-term rental for $60,000 down, taking his tax bill down to $21,000. The US government essentially paid 2/3 of his down payment!

© 2025 Tax Strategy 365

TERMS & CONDITIONS | PRIVACY POLICY

This site is not a part of the YouTube, Bing, Google or Facebook website; Google Inc, Microsoft INC or Meta Inc. Additionally, This site is NOT endorsed by YouTube, Google, Bing or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc. BING is a trademark of MICROSOFT Inc.