Discover How Real Estate Investors Like You Are Saving Thousands in Taxes with Our Proven Strategies!

Are you tired of watching your hard-earned profits vanish into taxes? Most real estate investors pay more than they should because they lack a tailored tax strategy.

Without a customized tax plan, you’re likely overpaying the IRS year after year. Imagine how much faster you could grow your investments if you kept more of your money.

At Tax Strategy 365, we craft personalized tax plans designed specifically for real estate investors. Our team of real estate-savvy CPAs ensures you get every deduction possible.

Features:

48 Hour Email Policy: We will respond to any email inquiry within 48 hours.

Custom Tax Plan: We don't give you anything cookie cutter. We develop a tax plan specifically for your situation.

Industry Expertise: Our Team of CPA's are not only tax experts, but we also invest in real estate and can help you from a tax and investment perspective!

Weekly Coaching Calls: Ryan himself does a once-a-week group coaching call.

Benefits:

48 Hour Email Policy: Real Estate Investors need to make decisions quick. You won't have to wait around for your CPA to respond anymore.

Custom Tax Plan: You have a custom 1 of 1 tax plan for your unique situation delivered over 3 zoom calls.

Industry Expertise: You will have a team that not only puts on their "CPA hat" but also their "investor hat" when helping you make decisions.

Weekly Coaching Calls: Learn from Ryan all the things you need to know about retirement planning, tax advice, legal structure and more in order to become a better investor!

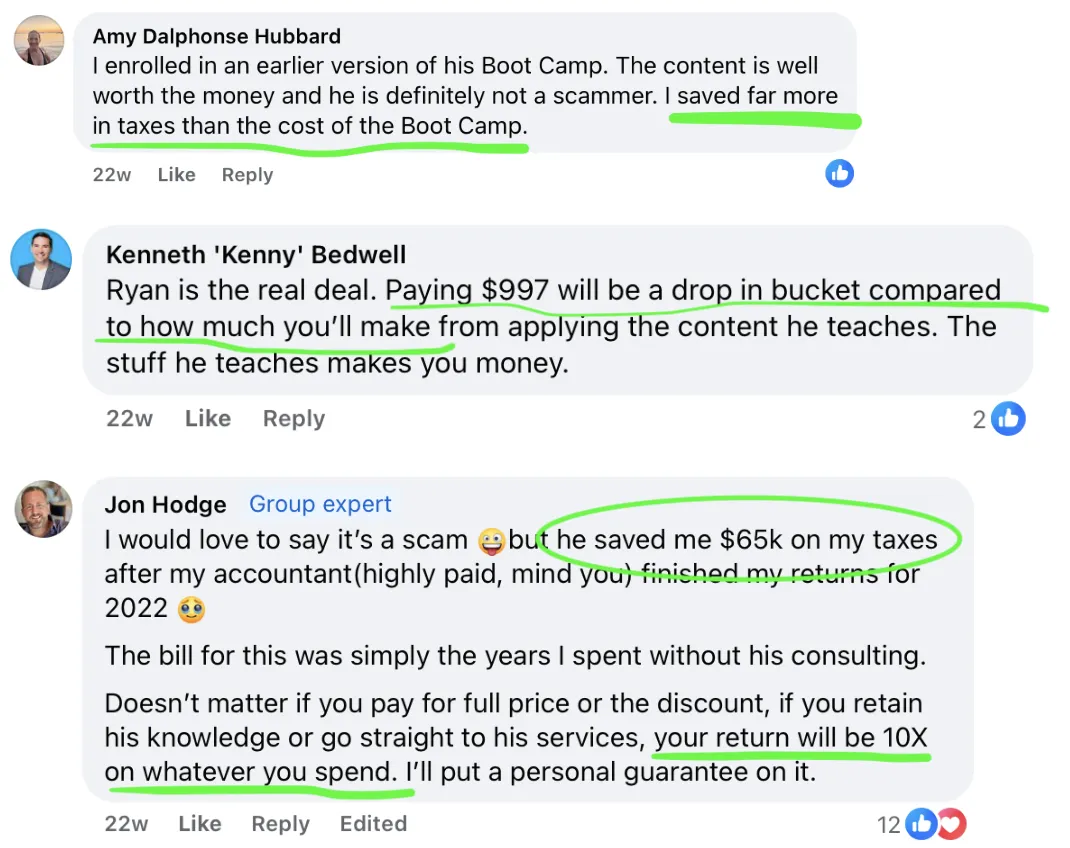

With over 400 real estate investors helped, our track record speaks for itself. Our CPA team invests in real estate themselves, so they understand your challenges and goals.

How much would you pay to save thousands in taxes every year? Our service pays for itself many times over with the tax savings you'll achieve

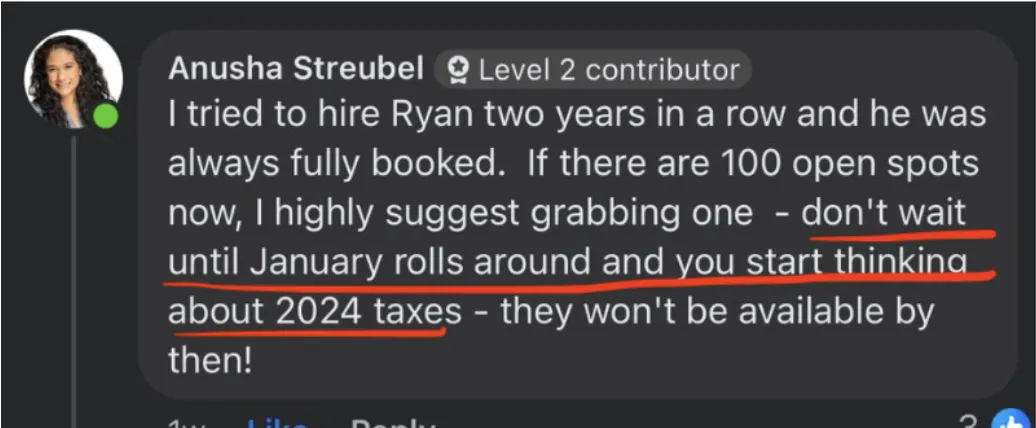

Limited spots left for 2024 tax planning – secure your savings now before it’s too late!

Ready to stop overpaying on your taxes? Click below to apply and become a client today!

Apply risk-free – your initial consultation comes with zero obligation.

Not sure if this is right for you? Check out our FAQs to see how we help investors at every level.

How much does Tax Strategy 365 cost?

The total pricing for our Tax Strategy 365 service is $5,000.

We understand that investing in your financial education is a big decision, so we offer the flexibility of two monthly payments to make it more manageable for you or a monthly subscription payment option. This way, you can spread out the cost while still gaining access to all the valuable content and resources that the service has to offer.

What is included in the Tax Strategy 365 Service?

Review of prior year returns

Review of current legal structure

3- 1 hour Tax Planning call w/a member of our team

Weekly Office Hours/Ask me anything w/Ryan

Access to modules/templates that aren't available anywhere else

Unlimited Email Support

Full transparency and guidance on your tax plan/situation for the year

Does tax strategy include tax preparation?

Tax strategy and tax preparation are separate services with separate pricing.

That being said, if you're a tax strategy client, you'll get access to special pricing on your tax return preparation.

How much does tax preparation cost?

For tax strategy clients, tax preparation starts at $2,000.

Without an active tax strategy package, tax preparation starts at $4,000.

I've never paid this much before. Why should I now?

We understand we may not be the lowest priced option around.

However, unlike most CPAs who simply prepare and file tax returns and never give any advice on how to improve your tax situation, we will be providing you with advice on how you can best take advantage of the tax code to minimize your tax bills and have the peace of mind that you’re not missing out on major tax-saving opportunities.

Additionally, most CPAs are generalists and aren’t even aware of all the opportunities, and in some cases, we’ve found they may actually be costing you money - making them not so cheap after all!

Where are you located?

We are a 100% virtual organization with members across the United States.

Do you provide audit support?

We do provide audit support for an additional hourly fee.

Choose Your Journey to Tax Excellence

Journey 1

Building a Tax Advisory & Consulting Practice

Scale, streamline, and systemize your advisory business.

Turn compliance clients into year-round advisory opportunities while mastering operational efficiencies for sustainable growth. This track covers pricing, hiring, marketing, and client engagement essentials to help you build a practice you love.

WHAT YOU’LL LEARN:

Crafting solid engagement letters and pricing models.

Transforming compliance clients into year-round

partners.

Marketing

strategies that drive consistent growth.

Recruiting and training the right team to scale your business.

Bonus:A Power Checklist for the ultimate year-end tax planning session.

Journey 2

Tax and Legal Foundations: Core Strategies for All Levels

Master the fundamentals that drive financial success.

Perfect for business owners and advisors, this track delivers essential insights on asset protection, tax planning, estate strategies, and IRS compliance.

WHAT YOU’LL LEARN:

Unlock estate planning with Revocable Living Trusts.

Maximize retirement savings through Solo 401(k) plans.

Real estate strategies: Short-term, long-term, and self-rentals.

Learn asset protection that actually works.

Navigate IRS resolution with confidence and ease.

Journey 3

Advanced Insights: Unlock Complex Tax Strategies

Top-tier strategies for high-value clients.

Designed for experienced professionals, this track offers in-depth guidance on prime tax strategies, entity structuring, and payroll solutions. Gain the insights needed to handle complex business scenarios with confidence.

WHAT YOU’LL LEARN:

Report multi-entity structures with Forms 1065 & 1120S.

Maximize tax savings using Bonus Depreciation & Section 179.

Seamlessly relocate clients to tax-free states.

Navigate business sales and acquisitions smoothly.

Use 105 Plans to save clients on healthcare costs.

2024 Tax Strategy 365. All rights reserved.